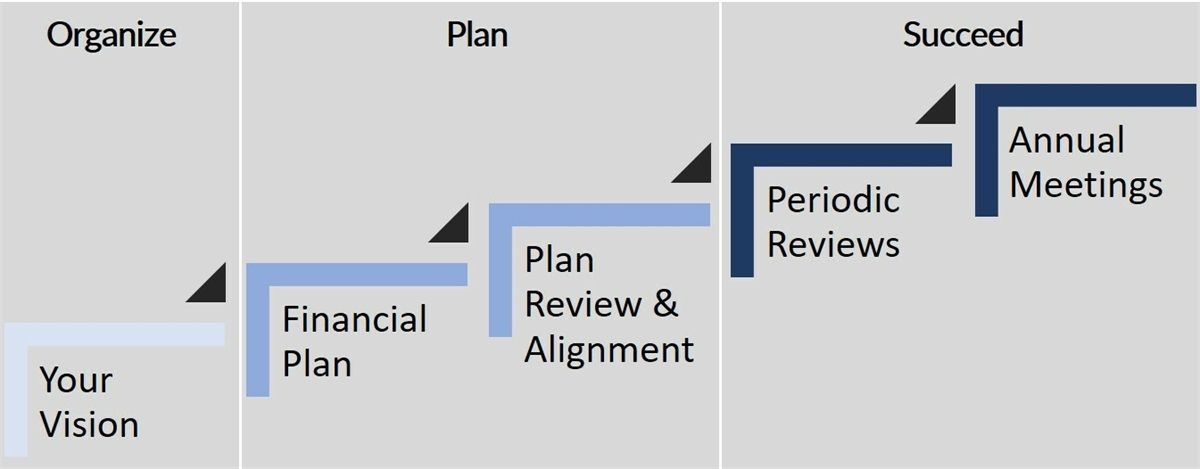

Our Process

A clear, thoughtful path guided by what matters most to you

Your True Wealth is shaped by your values, your goals, and the life you want to create. Our process helps you organize your financial world, design a vision for the future, and build a plan that grows with you—every step of the way.

How We Turn Vision Into Action

A collaborative process centered on your life and priorities

Our planning process blends deep discovery, thoughtful design, and ongoing stewardship. Each step ensures your financial decisions stay aligned with your long-term goals and the things that bring meaning to your life.

Your Vision

We begin by gathering and organizing every piece of your financial picture—assets, income, obligations, goals, and values. Together, we clarify what matters most to you and define your desired future. This helps us establish milestones, timeframes, and a vision that becomes the anchor of your entire plan.

Financial Plan

We analyze your current financial situation, including cash flow, investments, insurance, taxes, and estate planning. From there, we develop a personalized financial plan designed to move you toward your milestones with clarity and confidence. We present clear recommendations so you can see exactly how each decision supports your long-term vision.

Plan Review and Alignment

Your concerns, preferences, and life updates guide our adjustments. We refine your recommendations until they feel aligned and achievable—helping you make informed decisions that support greater fulfillment and long-term wellbeing. Once aligned, we help implement each part of the plan, coordinating with attorneys, CPAs, and other professionals when needed.

Periodic Reviews

Life changes, and your plan should evolve with it. We review your progress regularly, make strategic adjustments, and ensure your plan stays aligned with your priorities and True Wealth goals. Every review keeps you confident, supported, and moving forward.

Annual Meetings

Each year, we take a deep look at what has changed—financially, personally, and emotionally. Together, we refine your plan to ensure it continues to serve your life, protect your resources, and reflect what you value most. This rhythm helps you sustain True Wealth over time.